'We don't expect silver to catch up with the gold rally' says Goldman Sachs

ANI

08 May 2025, 17:55 GMT+10

New Delhi [India] May 8 (ANI): Gold will continue to outperform silver in the precious metals market, said Goldman Sachs in a recent report.According to the report the historic relation between gold and silver prices which typically ranges between 45-80 has been 'broken' for the first time since 2022, attributed to the substantial increase in gold purchases by central banks and this trend has not been followed by gold's sister metal - Silver.'We don't expect silver to catch up with the gold rally because higher central bank gold demand has structurally lifted the gold-silver price ratio.' said the report.However, silver has been supported by the China's solar boom, but this industrial demand is not enough to offset strong buying of gold by central bank.Gold's appeal to central banks is attributed to its physical properties, making it more suitable for reserve management. Gold is scarcer, more valuable per ounce, and denser than silver, simplifying storage, transport, and security.The report suggests that even with a slowdown in Chinese solar production and persistent recession risks, central bank gold buying is expected to remain robust in 2025, further supporting gold's strong performance.'Given the high correlation in flows, renewed demand for gold in 2025 is likely to lift silver as well. This was already evident in the 1Q25-rally, when ETF inflows and speculative buying supported both gold and silver.' Goldman Sachs said.Goldman Sachs remains bullish for gold with a base case of USD 3,700/toz by year-end and of USD 4,000 by mid-2026. Adding 'concerns about US governance and institutional credibility, a flight to safety, and sharper Fed rate cuts are likely to push gold prices well above our already bullish base case in a potential US policy-driven recession.'While, 'if a recession occurs, we estimate that the acceleration in ETF inflows would lift the gold price to $3,880 by year-end. In extreme tail scenarios where market focus on the risks of Fed subordination or of changes in US reserve policy was to grow, we estimate that gold could plausibly trade near $4,500/toz by end-2025,', as per report. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Perth Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Perth Herald.

More InformationInternational Business

Section'We don't expect silver to catch up with the gold rally' says Goldman Sachs

New Delhi [India] May 8 (ANI): Gold will continue to outperform silver in the precious metals market, said Goldman Sachs in a recent...

Yas Island celebrates announcement of Disney Theme Park Resort

ABU DHABI, 8th May, 2025 (WAM) -- Miral and The Walt Disney Company marked a historic milestone with the official announcement of the...

Golf: Indian-Americans Bhatia, Theegala set for Truist Championship alongside champion McIlroy

Philadelphia [US], May 8 (ANI): Prominent Indian-American in the world of golf, Akshay Bhatia, is gearing up for another start at the...

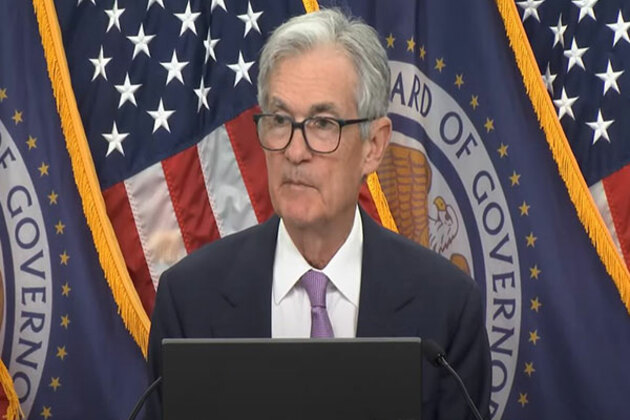

Economic Watch: U.S. Fed holds rates steady amid economic uncertainty

U.S. Federal Reserve Chair Jerome Powell attends a press conference in Washington, D.C., the United States, on May 7, 2025. (Xinhua/Hu...

Indian markets open in Green as investor confidence stays strong despite Pakistan tensions

Mumbai (Maharashtra) [India], May 8 (ANI): Indian stock markets opened higher on Thursday, reflecting strong investor confidence in...

US Fed keeps interest rates unchanged at 4.25-4.50% amid rising unemployment, inflation risks

New Delhi [India], May 8 (ANI): The US Federal Reserve has decided to keep interest rates unchanged at 4.25 per cent to 4.50 per cent,...

Australia

SectionAustralian police and partners smashing drug cartels

Every day, police across Australia investigate thousands of incidents—any one of which could unlock a major case on the other side...

Australia inflation hits 3-year low, boosting rate cut hopes

SYDNEY, Australia: A key measure of inflation in Australia has cooled to its lowest level in three years, lending weight to expectations...

"You have given your best to Indian cricket": Sachin lauds Rohit's "remarkable" Test journey

New Delhi [India], May 8 (ANI): India's 'God of Cricket' Sachin Tendulkar on Thursday said Rohit Sharma's cricket journey has been...

Rohit Sharma: A look at batter's contrasting returns at home, away Tests

New Delhi [India], May 8 (ANI): As the world reminisces over Rohit Sharma's Test career following his retirement, one could easily...

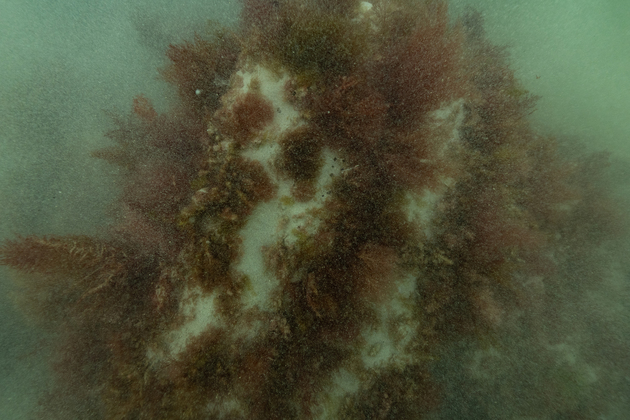

AUSTRALIA-CANBERRA-19TH CENTURY SHIP-WRECK-UNEARTHED

(250508) -- CANBERRA, May 8, 2025 (Xinhua) -- This photo taken on March 12, 2025 shows part of the windlass protruding from the seabed....

How could India fill void left by Rohit Sharma at the top in Tests?

New Delhi [India], May 8 (ANI): Indian batter and skipper Rohit Sharma announced his retirement from Test cricket on Wednesday after...