Gold gains 25% in 2025; outlook remains firm: Motilal Oswal

ANI

20 Apr 2025, 15:11 GMT+10

New Delhi [India], April 20 (ANI): Gold has delivered a stellar performance in the first four months of 2025, gaining nearly 25 per cent and marking all-time highs on both MCX and COMEX.

Silver has also followed suit with a 15 per cent price gains on COMEX.

This sharp rally is attributed to a combination of heightened geopolitical risks, trade tensions--particularly between the U.S. and China--and a surge in safe-haven demand from both institutional and retail investors, Motilal Oswal Financial Services Ltd (MOFSL) said in a report.

The outlook for gold remains constructive, Motilal Oswal said.

Persistent trade tensions, inflationary pressures, and central bank gold purchases are expected to continue supporting prices.

As per Motilal Oswal, technical levels indicate strong support for gold around Rs 91,000 per 10 grams and resistance near Rs 99,000 on MCX, while on COMEX, key levels to watch are USD 3,100 per ounce and USD 3,400.

With the global economy navigating through policy uncertainty and slowing growth, gold is likely to remain an attractive asset class.

'In an environment dominated by policy uncertainty, inflationary pressures, and volatile geopolitics, gold continues to be a beacon of stability. As central banks bolster their reserves and investors seek safety, we believe gold will remain a favoured asset. Barring any significant resolution in global trade tensions, we maintain a 'buy on dips' view from a medium to long-term perspective,' said Navneet Damani, Group Senior Vice President, Head Commodity and Currency Research, Motilal Oswal Financial Services.

Gold's momentum has notably outpaced silver's so far this year, both in terms of scale and pace.

Following recent comments from President Trump regarding higher tariffs on Chinese goods, gold briefly corrected but quickly recovered--demonstrating resilience and investor confidence.

The Trump administration's aggressive trade stance has targeted dozens of trading partners, with particularly steep tariffs imposed on China (up to 245 per cent), prompting retaliatory measures from Beijing.

This has led to market-wide concerns of a prolonged slowdown or potential stagflation in the U.S. economy.

Further compounding these risks is a weakening US dollar, which has declined by over 7 per cent against major global currencies this year.

'Central banks, especially in emerging markets like China, have been steadily increasing their gold reserves, further bolstering demand and price stability,' MOFSL said.

The Federal Reserve's monetary policy has also influenced market sentiment. After three interest rate cuts in 2024, the Fed has taken a 'wait and watch' approach in 2025 to assess the economic fallout from ongoing trade policies.

While President Trump has openly advocated for further rate reductions to stimulate growth, Fed Chair Jerome Powell has maintained a cautious stance, citing inflationary risks from tariffs and broader economic uncertainties.

'However, the broader global macroeconomic environment continues to favour gold and other safe-haven assets. Unless a meaningful resolution to global trade disputes is reached, the upward trajectory for bullion prices appears well-supported in the medium to long term,' MOFSL added. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Perth Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Perth Herald.

More InformationInternational Business

SectionReport: Fuel prices unchanged in Ireland

DUBLIN, Ireland - Fuel prices across Ireland have held firm for another month, with no change recorded in petrol, diesel, or electric...

Hong Kong suspends goods deliveries to 'bullying' U.S. as trade tensions rise

HONG KONG - Mail services between Hong Kong and the United States are the latest casualty in an escalating trade dispute, with Hong...

Gold gains 25% in 2025; outlook remains firm: Motilal Oswal

New Delhi [India], April 20 (ANI): Gold has delivered a stellar performance in the first four months of 2025, gaining nearly 25 per...

Financial markets must play crucial role to fulfil India's aspirations: RBI Governor

New Delhi [India], April 20 (ANI): India's financial markets must play a crucial role if the country is to successfully navigate global...

India's foreign exchange reserves climb to USD 677.84 billion, sixth weekly gain

Mumbai (Maharashtra) [India], April 20 (ANI): India's foreign exchange reserves (Forex) rose USD USD 1.567 billion to USD 677.835 billion...

FM Nirmala Sitharaman to visit USA and Peru beginning April 20

Mumbai (Maharashtra) [India], April 19 (ANI): Union Minister for Finance and Corporate Affairs Nirmala Sitharaman will be on an official...

Australia

SectionAustralian lawmakers hunt alleged criminal from Ireland

The Australian Federal Police (AFP) are appealing to the public for assistance in locating Michael Connors, a 25-year-old Irish national...

This is just the beginning: BCA president Rakesh Tiwari after Vaibhav Suryavanshi dream IPL debut

Jaipur (Rajasthan) [India], April 20 (ANI): Bihar Cricket Association (BCA) president, Rakesh Tiwari, lavished praises on batter Vaibhav...

Man dead after stabbing in southeast Melbourne

MELBOURNE, Australia, April 20 (Xinhua) -- A man has died after being stabbed during a fight in Melbourne, Australia. Police said...

(SP)SAUDI ARABIA-JEDDAH-F1-GRAND PRIX-QUALIFYING

(250420) -- JEDDAH, April 20, 2025 (Xinhua) -- McLaren's driver Oscar Piastri of Australia drives during the Qualifying session of...

Preity Zinta calls out "fake" quote about Rishab Pant's performance

Mumbai (Maharashtra) [India], April 19 (ANI): Bollywood actor and Punjab Kings' co-owner Preity Zinta on Saturday shut down the reports...

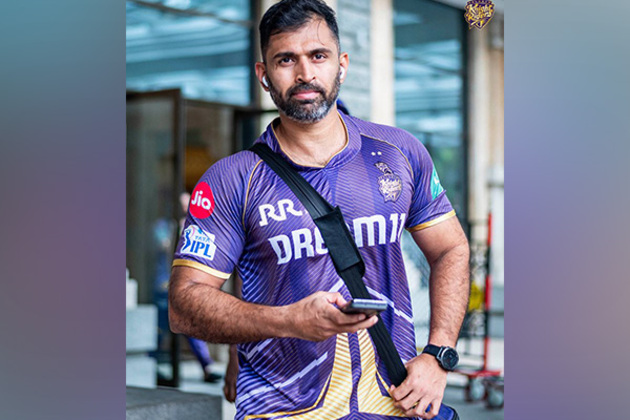

Abhishek Nayar returns to KKR coaching staff following removal as India's assistant coach

Kolkata (West Bengal) [India], April 19 (ANI): Former Indian cricketer Abhishek Nayar has returned to the Kolkata Knight Riders (KKR)...