Trump claims tariffs are working

RT.com

07 Apr 2025, 20:23 GMT+10

The country is raking in billions from duties already in place, according to the US president

Tariffs are yielding significant economic benefits, US President Donald Trump has claimed, citing a spike in revenue from duties on imports, and declining oil prices.

Trump took to social media on Monday morning, amid the global fallout from an escalating trade war with China and other major global players.

Last week, the US implemented a levy on imports, ranging from 10% to 50%, on all countries it perceives as engaging in unfair trade practices. The EU faces a blanket 20% tariff as of Wednesday, while Chinese goods have been hit with 34% duties.

The measures have prompted multiple countries to seek to negotiate with Washington, however, Beijing has announced a reciprocal 34% tariff on US goods, effective April 10.

"Oil prices are down, interest rates are down (the slow-moving [Federal Reserve] should cut rates!), food prices are down, there is NO INFLATION, and the long-time abused USA is bringing in Billions of Dollars a week from the abusing countries on tariffs that are already in place," Trump wrote on Truth Social.

The escalation of the tariff war has significantly impacted oil prices. Brent crude, the global benchmark, fell roughly 14% over the past five days to just over $64 a barrel on Monday. Russia's flagship Urals crude grade has declined alongside major oil benchmarks, approaching $50 per barrel for the first time in nearly two years.

Global stock markets have also plunged since the tariff announcement, however, US stocks managed to recover on Monday following last week's collapse.

The Federal Reserve Board, the entity responsible for formulating US monetary policy and overseeing financial institutions in the country, is scheduled to conduct a closed-door meeting on Monday.

READ MORE: The art of (no) deal: Can the EU stand up to Trumps tariffs?

The benchmark interest rate, known as the federal funds rate, is currently set at a target range of 4.25% to 4.50%. Over the past year, the Federal Reserve adjusted the rate multiple times, lowering it in the last three meetings, the last of which was in December 2024.

(RT.com)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Perth Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Perth Herald.

More InformationInternational Business

SectionTrump claims tariffs are working

The country is raking in billions from duties already in place, according to the US president Tariffs are yielding significant economic...

Xinhua Headlines: U.S. tariff hikes deepen strain on EU's sluggish economy

* Analysts warn that the sweeping U.S. tariffs and potential EU retaliation could trigger trade flow disruptions, stifle growth prospects,...

Trumps tariffs trigger crypto market sell-off

Bitcoin has plunged by 10%, while the broader market has recorded over $1.38 billion in liquidations The Bitcoin price has dropped...

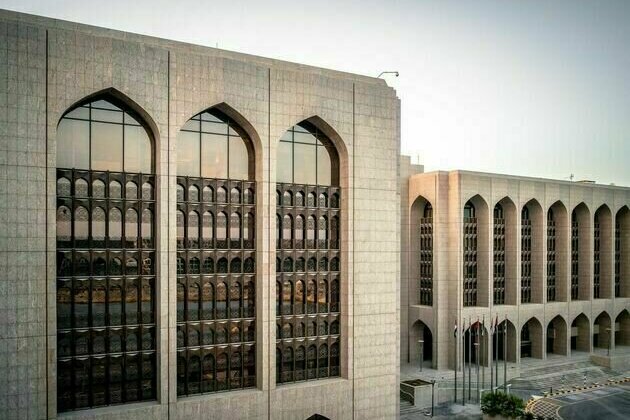

CBUAE 2024 Annual Report highlights UAE's leadership in strengthening financial sector

ABU DHABI, 7th April, 2025 (WAM) -- The Central Bank of the UAE (CBUAE) today released its 2024 Annual Report, embodying achievements...

Risk of US recession at 45% Goldman Sachs

The Wall Street bank has raised the odds of a downturn in the countrys economy following Donald Trumps massive tariff hike Goldman...

Congress' Prithviraj Chavan slams PM Modi's handling of bilateral with US as Trump's tariffs cause havoc in markets

Mumbai (Maharashtra) [India], April 7 (ANI): Former Maharashtra Chief Minister and Congress leader Prithviraj Chavan on Monday slammed...

Australia

SectionHarry Brook appointed as England's new white-ball captain

London [UK], April 7 (ANI): Young batter Harry Brook was announced as England's new white-ball captain following Jos Buttler's resignation...

Tri-services all women sailing expedition flags off from Mumbai for Seychelles

Mumbai [India], April 7 (ANI): A tri-services all-women expedition has been flagged off from Mumbai for Seychelles which comprises...

Trumps tariffs send European stocks tumbling

The pan-European Stoxx 600 index, which tracks the leading companies in the region, has plunged to its lowest level in 16 months ...

Mumbai Indians part ways with two-time WPL-winning coach Charlotte Edwards

Mumbai (Maharashtra) [India], April 7 (ANI): Mumbai Indians have parted ways with their two-time Women's Premier League head coach...

Asian stocks plunge amid Trump tariffs fallout

Markets across Asia-Pacific opened sharply lower, extending last weeks global sell-off Asian stock markets plunged on Monday, extending...

Election Diary: Jim Chalmers highlights expectations of May interest rate cut - after the election

Amid the chaos of the tariff crisis and the dark clouds internationally, there is a potential silver lining for Australian mortgage...