Govt should ease lending restrictions on NBFCs to improve credit for MSMEs: World Bank

ANI

06 Mar 2025, 12:46 GMT+10

New Delhi [India], March 6 (ANI): In a bid to enhance the availability of credit for Micro, Small, and Medium Enterprises (MSMEs), the World Bank, in its latest report, has stated that the government should remove the interest cap on NBFCs to ease the lending restriction.

The World Bank's report outlined several key recommendations aimed at strengthening Non-Banking Financial Companies (NBFCs).

It said, 'Providing adequate financing for micro, small and medium enterprises (MSMEs) by strengthening NBFCs' ability to lend to them by removing the existing interest cap on NBFCs to be eligible for guarantees provided by the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)'

These recommendations focus on improving NBFCs' access to liquidity, easing restrictions on their lending, and introducing risk-sharing mechanisms to facilitate bank funding to NBFCs.

One of the primary measures suggested is the removal of the existing interest cap on NBFCs to be eligible for guarantees under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

By eliminating this cap, the World Bank says that the NBFCs will have greater flexibility in lending to MSMEs, ensuring better access to financing for small businesses.

Additionally, introducing risk-sharing mechanisms for banks that lend to NBFCs would encourage greater participation from the banking sector in supporting NBFC funding.

The tightening of regulatory supervision on NBFCs has led to concerns over liquidity access, particularly for smaller and medium-sized NBFCs.

To address this, the World Bank recommends the introduction of a permanent liquidity arrangement that includes periodic liquidity facilities through development finance institutions (DFIs), Targeted Long-Term Repo Operations (TLTROs), and partial credit guarantee schemes. Such measures would ensure a steady flow of funds for NBFCs, reducing their dependence on short-term borrowing and making financing more accessible for MSMEs.

During the pandemic, government-backed long-term lending support was largely accessible only to well-established and financially sound NBFCs, leaving smaller and medium-sized players struggling for funds.

To prevent a recurrence of such disparities, the World Bank suggests that the government and the Reserve Bank of India (RBI) implement a more structured and permanent liquidity mechanism.

This would provide much-needed stability to NBFCs, particularly those catering to MSMEs, and ensure that smaller lenders are not left behind in times of financial distress.

In conclusion, strengthening NBFCs through regulatory flexibility, improved liquidity access, and risk-sharing mechanisms will significantly enhance their ability to finance MSMEs. The recommendations put forth by the World Bank emphasize the need for a balanced approach--tightening regulatory supervision while simultaneously ensuring NBFCs have adequate liquidity support. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Perth Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Perth Herald.

More InformationInternational Business

SectionChanging Lives: SRMS Trust's Tuition Fee Waiver Scheme Empowers Meritorious, Underprivileged Students

HT Syndication New Delhi [India], March 6: Education has always been a powerful tool for social upliftment, but financial barriers...

Govt should ease lending restrictions on NBFCs to improve credit for MSMEs: World Bank

New Delhi [India], March 6 (ANI): In a bid to enhance the availability of credit for Micro, Small, and Medium Enterprises (MSMEs),...

"We began Winter Yatra to support people associated with Char-Dham Yatra": U'khand CM Dhami

Harsil (Uttarakhand) [India], March 6 (ANI): Uttarakhand Chief Minister Pushkar Singh Dhami said on Thursday that the State has launched...

PM Modi flags-off trek and bike rally in Uttarakhand's Harsil

Uttarkashi (Uttarakhand) [India], March 6 (ANI): Prime Minister Narendra Modi on Thursday flagged off the trek and bike rally in Harsil...

Uttarakhand: PM Modi joins local artists as they perform folk dance in Mukhwa

Uttarkashi (Uttarakhand) [India], March 6 (ANI): Prime Minister Narendra Modi on Thursday engaged with local artists as they performed...

PM Modi offers prayers at winter seat of Ganga in Mukhwa

Uttarkashi (Uttarakhand) [India], March 6 (ANI): Prime Minister Narendra Modi on Thursday offered prayers at the winter seat of Maa...

Australia

SectionTaiwan probes Chinese-crewed ship for undersea cable damage

TAIPEI, Taiwan: Taiwanese authorities are probing a Chinese-crewed cargo ship suspected of damaging an undersea communications cable...

Camila Osorio ousts Naomi Osaka at BNP Paribas Open

(Photo credit: Taya Gray/The Desert Sun / USA TODAY NETWORK via Imagn Images) Naomi Osaka, back in action for the first time in two...

IML 2025: Sachin Tendulkar's blistering fifty in vain as Australia Masters beat India Masters by 95 runs

Vadodara (Gujarat) [India], March 6 (ANI): It's a battle etched in cricketing folklore -- one that has thrilled generations of fans,...

Australia's Chief of Defence Force hosts CDS General Chauhan, expresses commitment to working with India on enhancing interoperability

Canberra [Australia], March 6 (ANI): Australia's Chief of the Defence Force, Admiral David Johnston AC RAN hosted Chief of Defence...

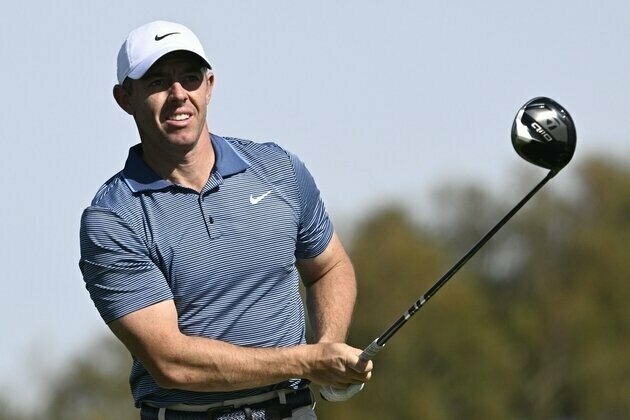

Elite field competing at Bay Hill for Arnold Palmer Invitational

(Photo credit: Denis Poroy-Imagn Images) The top five golfers in the world rankings -- and 47 of the top 50 -- are gathered at Bay...

HILDA data shows income inequality is at a 20-year high

The 19th annual report from the Household, Income and Labour Dynamics in Australia (HILDA) Survey was released today. The HILDA...